Ethena, the team behind the USDe synthetic dollar protocol, withdrew its bid to issue Hyperliquid’s USDH stablecoin, conceding to concerns raised in direct discussions with community members and validators.

In a X statement Thursday, the Ethena team acknowledged pushback over not being a Hyperliquid-native project and said it would step aside, congratulating rival Native Markets, now viewed as the frontrunner in the race.

“While some are complaining about their [Native Markets] lack of credibility I think their success here perfectly embodies everything which is so special about Hyperliquid and their community,” wrote Ethena Labs founder Guy Young, adding:

“It is a level playing field where emergent players can win the hearts of the community and are given a fair shot at succeeding.”

Ethena’s withdrawal marks a major shift in the bidding process, which has drawn proposals from multiple teams to issue USDH, Hyperliquid’s forthcoming native stablecoin.

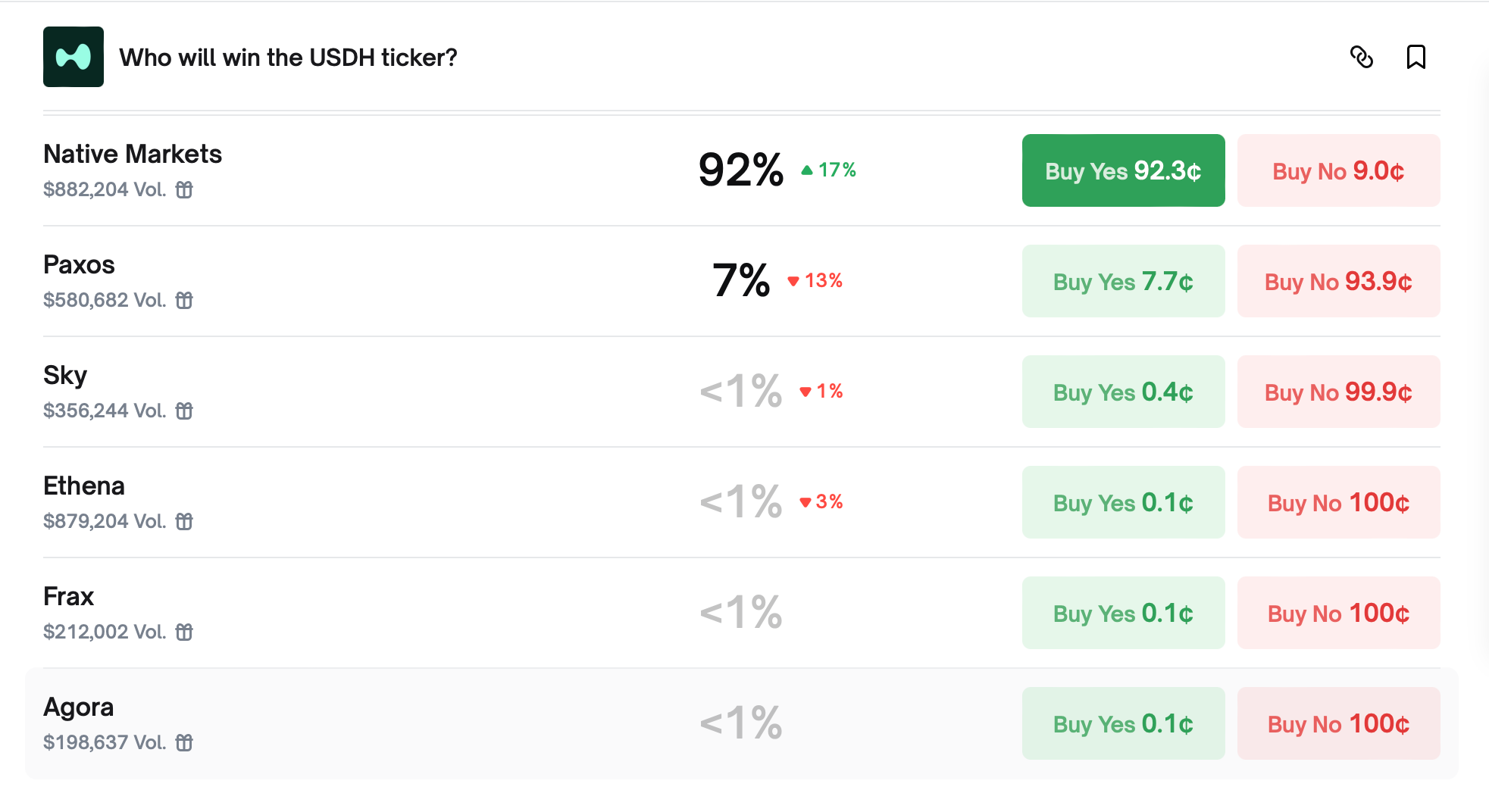

With Ethena out, prediction markets on Polymarket are giving Native Markets a 92% chance of winning, with Paxos in second place at roughly 7% at time of writing.

Critics question the fairness of the USDH bidding process

Not everyone agrees with Ethena’s assessment that the bidding was a level playing field. Critics have questioned Native Markets’ limited track record and even the fairness of the process itself.

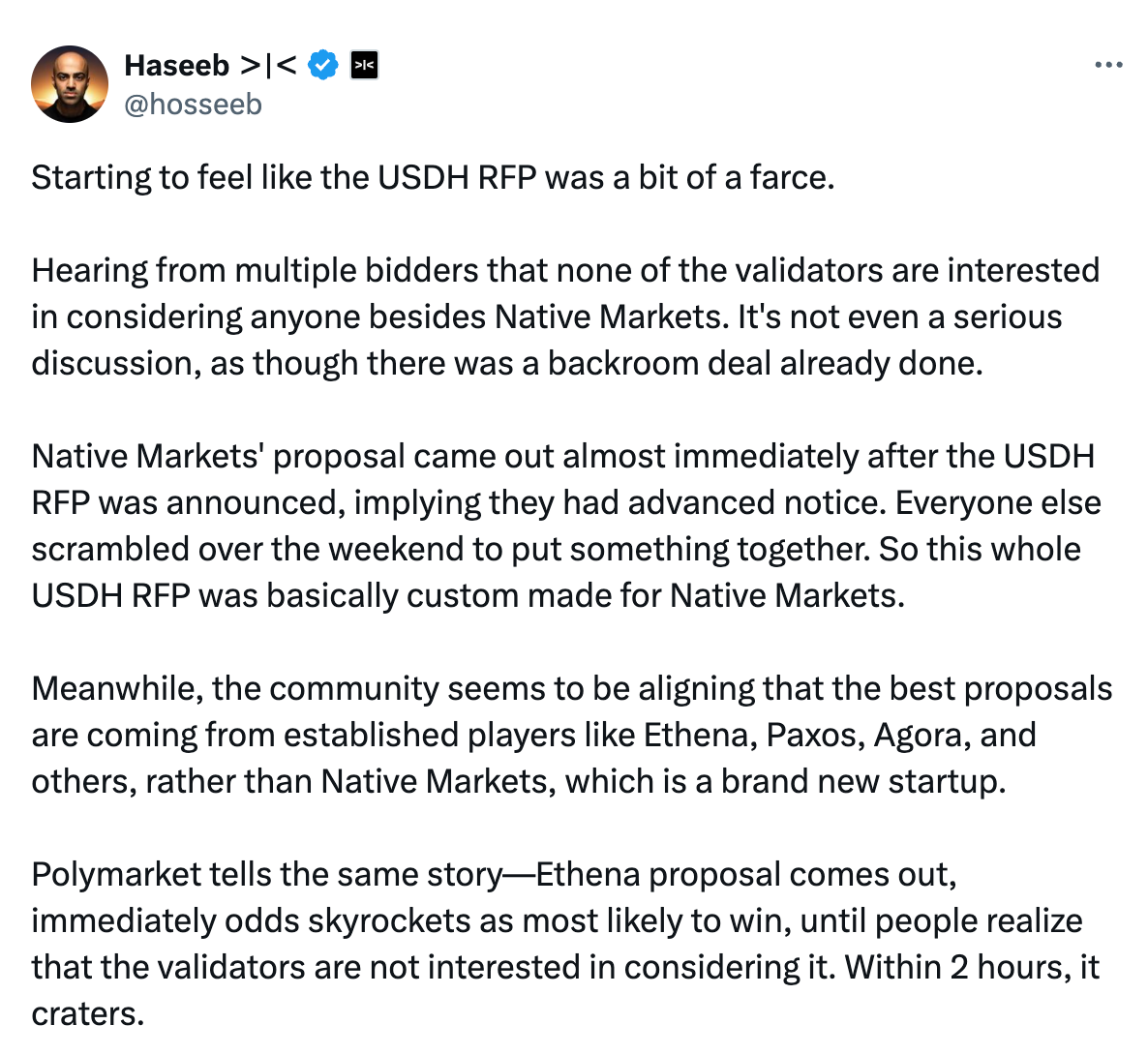

Haseeb Qureshi, managing partner at crypto venture firm Dragonfly, wrote on Tuesday that he was “starting to feel like the USDH RFP was a bit of a farce,” claiming validators appeared unwilling to seriously consider any team besides Native Markets.

He added that Native Markets’ bid appeared almost immediately after the Request for Proposals was announced, “implying they had advanced notice,” while other bidders scrambled to prepare submissions. He said the process seemed “custom made for Native Markets,” despite stronger proposals from more established players like Paxos, Ethena and Agora.